Does common wealth generate our nation’s health?

Sorry for the cheap rhyme, my poet daughter just flinched…but it’s too true so I had to use it and it does what a good title can by helping orient you to what I am up to.

I don’t mean commonwealth, a label used historically to designate a specific political entity and its assets. At our independence most of the founding 13 colonies chose to call themselves states. Three declared they were commonwealths—Virginia, Pennsylvania, and Massachusetts; later when Kentucky split off from Virginia it retained its sense of self as a commonwealth—but historians and political scientists will tell you that today in the US there isn’t any difference of note between a state and a commonwealth.

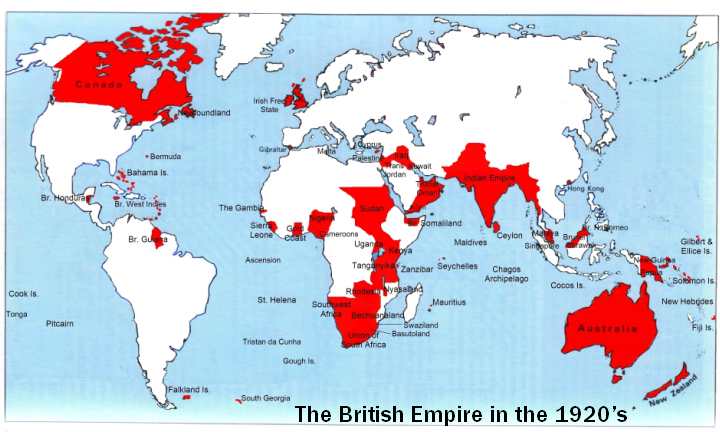

And once upon a time there was a British Commonwealth that included nearly half the world with its remnants now in the Commonwealth of Nations.

Commonwealth was first used in the 15th century to mean something like the “common well-being” though it must have lost that meaning by the colonial heyday of the British Commonwealth.

I have always sensed that common wealth existed and relied on it time and again without ever examining it closely. It seems to me that I am and that we all are well served by the existence of common wealth and we flourish when there is more common wealth for all of us to share and each of us to leverage and we stumble in decline when there is less of it.

We’ve pretty much abandoned the 15th century usage for commonwealth as a “common well-being”—and when I do a Google search on ‘common wealth’ as two words it corrects to ‘commonwealth’ and in those search results it is difficult to find any evidence of the idea of common wealth, an idea that I have come to understand and appreciate all the more when I find it has served us in very important places in our culture.

1.The strategy behind start-up incubators is that individual companies benefit when provided access to common wealth. If you asked 100 first-time entrepreneurs which they would choose, attempting to start and grow their businesses outside a start-up incubator or inside one that provides easy access to other entrepreneurs who eagerly share experiences and knowledge and networks with each other, along with the ready presence of experienced mentors and their networks and their physical resources, nearly 100% of our first-time entrepreneurs would choose the incubator, since leveraging that common wealth, while contributing to it, increases the likelihood of success for each and for all.

2.There is common wealth supporting most all start-up successes. Research finds that those entrepreneurs who do go it alone are more likely to be successful when they in fact don’t go it alone—when they have partners, when they tap into the common wealth of rich social capital networks, when they find they are able to dip into the common wealth of a broad supportive community. The richer the legacy of entrepreneurial activity in a region the more likely it is that there will be more entrepreneurial successes among entrepreneurs in that region, in no small part due to the entrepreneurial common wealth that has been established close at hand.

The research project on topic I am most familiar with comes from Martin Ruef, the fellow Duke brought in to take over the program where I taught for 14 years. He published his research as ‘The Entrepreneurial Group’. While the media continue to present the stories of the lone visionary entrepreneur Ruef’s research is conclusive: the typical American start-up isn’t the work of an entrepreneur but of teams of entrepreneurs and their networks.

3.Institutional knowledge, both formal and informal, is an organization’s common wealth. How well an organization nurtures and grows and distributes its common wealth—keeping it from becoming a status quo restricting creative performance—plays a vital role in an organization’s continued success. And the success individuals within corporations achieve depends a great deal on their ability to leverage the company’s common wealth to build new products or services or solve systemic problems as they also contribute to growing and refreshing their corporate common wealth.

4.Governments invest their citizens’ tax dollars to create the common wealth of public service infrastructure. Here the individuals’ benefits of leveraging our common wealth are abundantly clear. Imagine if we could measure the commercial impact of New Deal works projects like the Lincoln Tunnel, used by over 100,000 vehicles every day, some delivering goods and others carrying customers for those goods, between Manhattan, NY and Weehawken, NJ; the Grand Coulee Dam, providing cheap electrical power to a huge portion of the Northwest, including Boeing in Seattle and the ship yards of Portland as well as directing water to irrigate farms; the electrification of much of rural America; and the hundreds of schools and sewer systems and bridges and thousands of miles of roads constructed. What has been the cascading impact of individual benefits from leveraging all that common wealth?

More recently, consider what the commercial ROI for the Interstate Highway System has been.

Going forward the common wealth of our technology infrastructures become vitally important as well.

Our nation’s health depends on steady strategic investments that continually grow our public service infrastructure common wealth.

5.The common wealth of our public land holdings is likely closest to the 15th century understanding of commonwealth, and they were right as they could be. Starting in the 1400’s and until relatively recently it was easy to see how each member of a community was in a better position to thrive when there was good stewardship and sustained health to the land around them; when they were all able to benefit from the bounty of that public land equitably they would be better off individually and collectively.

6.All of these examples of the high leverage and compounding benefits of common wealth are vital to our health and our future success, individually and collectively, but none drives the growth of each of the other categories more powerfully than the common wealth generated from a fully educated citizenry. The investment we make in public education that prepares generation after generation to be the most creative and entrepreneurial citizenry we can be, more and more capable of creating advantage for ourselves and for our communities from the common wealth we find around us as we contribute to it, this is the highest leverage common wealth investment we can make.

Do you consider our economy recovered from the Great Recession? I do not. If recovery means returning to what it used to be, well then, we can’t recover, it’s not an option. For years before our crash the economy wasn’t as healthy as we pretended it was. Sure, the big banks criminally irresponsible games fooled most of us—so many of us wanted to be fooled—but worse, we had stopped investing in our common wealth.

Yes, the first category of common wealth, the presence of start-up incubators, has grown significantly, through the investments of successful entrepreneurs, universities and colleges, and various government initiatives. But the other categories of common wealth have been at best neglected, and for quite some time in too many cases.

So rather than recovery we need a rebirth, and investing in our common wealth makes it more likely that more of us will be part of the rebirth, and perhaps being more mindful of the importance of our common wealth will motivate the investment.

.